37573.ru

Tools

Entry Level Pay For Software Engineer

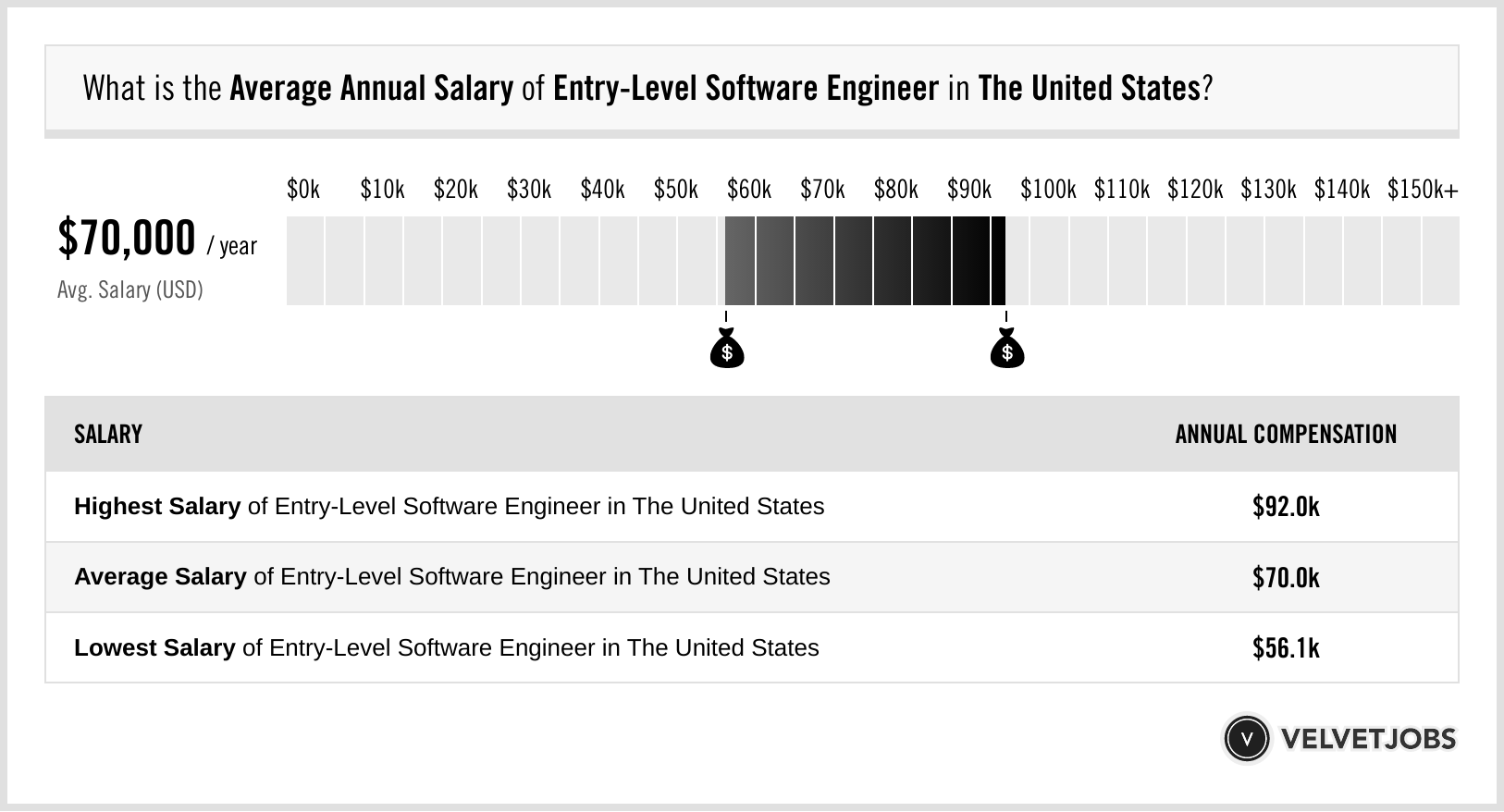

The starting salary for entry-level software engineers ranges from $60, to $,, depending on factors such as company size, skill level. Catherine Sinclair, a software engineer with Boeing Defence Australia pay out of pocket. Learn about our generous funding for courses, certificates. The average salary for a Entry Level Software Engineer is $ per year in United States. Learn about salaries, benefits, salary satisfaction and where. Below, are the average salaries for engineering students, by major and degree level. The entry-level salaries were calculated using the Summer , Fall Launch your career with an entry-level job in data, engineering, analyst, and other exciting fields at Intuit. Make a meaningful impact for approximately Training & Career Opportunity for Entry Level Software Engineer. Are you looking to join an elite team of Software Engineers, trained by the best, creating the. How Much Do Entry Level Software Engineer Jobs Pay per Year? · $24, - $38, 1% of jobs · $39, - $53, 5% of jobs · $65, is the 25th percentile. The general average salary for software engineers in the United States is around $,, but how much you can make as a software engineer depends on a number. The base salary for Entry Level Software Engineer ranges from $74, to $89, with the average base salary of $81, The total cash compensation, which. The starting salary for entry-level software engineers ranges from $60, to $,, depending on factors such as company size, skill level. Catherine Sinclair, a software engineer with Boeing Defence Australia pay out of pocket. Learn about our generous funding for courses, certificates. The average salary for a Entry Level Software Engineer is $ per year in United States. Learn about salaries, benefits, salary satisfaction and where. Below, are the average salaries for engineering students, by major and degree level. The entry-level salaries were calculated using the Summer , Fall Launch your career with an entry-level job in data, engineering, analyst, and other exciting fields at Intuit. Make a meaningful impact for approximately Training & Career Opportunity for Entry Level Software Engineer. Are you looking to join an elite team of Software Engineers, trained by the best, creating the. How Much Do Entry Level Software Engineer Jobs Pay per Year? · $24, - $38, 1% of jobs · $39, - $53, 5% of jobs · $65, is the 25th percentile. The general average salary for software engineers in the United States is around $,, but how much you can make as a software engineer depends on a number. The base salary for Entry Level Software Engineer ranges from $74, to $89, with the average base salary of $81, The total cash compensation, which.

The average salary for a Software Engineer in US is $ Learn more about additional compensation, pay by gender and years of experience for Software. Mean Entry-Level Salary (Payscale), Mean Annual Salary (BLS), Top 10 Percent IT Engineer (Software Developers), $70, · $, · $, · Construction. We've assembled this list of incredible companies—including Coinbase, Unum, and Jagermeister—that are all hiring entry-level software engineers. What it's really like to be a software engineer at Northrop Grumman. Learn More. Resources. What you should know about security clearances. Find out about. The average starting salary for a junior software engineer is $60k - 63k. Is this an accurate estimate? Also, how often should I expect a raise? Software Engineer · Avg. Salary $93, · Avg. Wage $ The average Entry Level Software Engineer salary range in United States is from $ to $ View Entry Level Software Engineer salaries across top. $55k – $65K (Entry level candidate); $75 – 85k (5+ years experience); $K – K+ (10 – 20+ years experience). Available jobs: Current job. Today's top + Entry Level Software Engineer jobs in United States. Leverage your professional network, and get hired. New Entry Level Software. Entry Level Software Engineer · Average $63, per year ; Junior Software Engineer · Average $77, per year ; Junior Software Engineer · Average $77, per year. As an Entry Level Computer Engineer, I make an average base salary of $ per Year in the US. Finger out salary benefits for Entry Level Computer. The average salary for a Software Engineer is $ in Visit PayScale 29%. An entry-level Software Engineer with less than 1 year experience can. Mean Entry-Level Salary (Payscale), Mean Annual Salary (BLS), Top 10 Percent IT Engineer (Software Developers), $70, · $, · $, · Construction. At the start of their career, entry-level software engineers typically possess a bachelor's degree in computer science or a related field. They focus on gaining. Average salaries for Google Entry Level Software Engineer: $ Google salary trends based on salaries posted anonymously by Google employees. If you're skilled enough to work at top companies, software engineering is a well-paid career. In the US, entry-level software engineer salaries start at around. Software Engineer - Entry Level. Hybrid work; Full time, Day; Travel: No. Apply The base salary may vary within the anticipated base pay range based on. The average junior software developer salary in the United States is $70, Junior software developer salaries typically range between $54, and $90, The median annual wage for software quality assurance analysts and testers was $, in May Job Outlook. Overall employment of software developers.

Cash App Cash Back Stores

You can use your Cash App Card to get cash back at checkout and withdraw cash from ATMs, up to the following limits: $1, per day; $1, per ATM transaction. Earn cash back on everyday purchases with a no annual fee credit card from Simplii Financial™. Cash App provides unlimited free withdrawals at in-network ATMs, as well as one instantly reimbursed out-of-network withdrawal per 31 days. Sign up for the Essential, Extra, or Everything plan then make a purchase with one of our partners through the link in-app. The additional cash back will be. Since , we've paid our members over $ Billion in Cash Back. Join now for an extra 10% Cash Back boost. Shop + stores using coupons or cash back! Cash back refers to a credit card that refunds a small percentage of money spent on purchases. You can also sign up through cash-back sites and apps. Earn cash back on purchases simply by shopping at stores you love including Doordash, AirBnb, JCPenny, Peet's Coffee, XBox, H&M, 37573.ru, Domino's, & Ulta. Ibotta is both a free app and browser extension that allows you to earn cash back on purchases at grocery stores, travel, online retailers and more. You can use your Cash App Card to make ATM withdrawals with your Cash PIN at any ATM. We do not support withdrawing funds from your 'Savings' balance. You can use your Cash App Card to get cash back at checkout and withdraw cash from ATMs, up to the following limits: $1, per day; $1, per ATM transaction. Earn cash back on everyday purchases with a no annual fee credit card from Simplii Financial™. Cash App provides unlimited free withdrawals at in-network ATMs, as well as one instantly reimbursed out-of-network withdrawal per 31 days. Sign up for the Essential, Extra, or Everything plan then make a purchase with one of our partners through the link in-app. The additional cash back will be. Since , we've paid our members over $ Billion in Cash Back. Join now for an extra 10% Cash Back boost. Shop + stores using coupons or cash back! Cash back refers to a credit card that refunds a small percentage of money spent on purchases. You can also sign up through cash-back sites and apps. Earn cash back on purchases simply by shopping at stores you love including Doordash, AirBnb, JCPenny, Peet's Coffee, XBox, H&M, 37573.ru, Domino's, & Ulta. Ibotta is both a free app and browser extension that allows you to earn cash back on purchases at grocery stores, travel, online retailers and more. You can use your Cash App Card to make ATM withdrawals with your Cash PIN at any ATM. We do not support withdrawing funds from your 'Savings' balance.

The average Ibotta saver earns over $ in cash back every year! Join the millions of savers earning cash back on everyday purchases simply by redeeming. Topcashback is the USA's leading cash back savings app. Simply sign up, search offers from over 7, retailers and make your purchase. Digital Wallets let you shop with confidence in millions of places online, within apps and in stores. With digital wallets you can speed through checkout. Earn cashback in store and online. Activate offers in the app, then pay with the Venmo Debit Card to earn up to 5% cashback.1 Rewards go. Most places will do cash back w/ Apple Pay, and some ATMs have contactless readers, so you can tap with Apple / Google Pay, enter your pin and. Welcome to our apparel line. It's called Cash by Cash App. It's made up of limited edition drops and collaborations. The Rogers Mastercard and Rogers Red World Elite Mastercard offer up to 3% cash back rewards with no annual fee. Offers let you save money instantly when you use your Cash App Card at coffee shops, restaurants, and other merchants. Shop Cash is a rewards program that's available to Shop app customers with a verified phone number in the United States or Canada, who pay for their orders. You'll also receive your gift certificate in your January statement. Track your annual cash back total through your statement, CIBC Mobile Banking App or CIBC. The Cash App Card is a Visa debit card that can be used to pay for goods and services from your Cash App balance, both online and in stores. How to Add Offers to Your Cash App Card · Go to the Card tab on your home screen · Select Add offer · Choose an offer · Select add · Use your offer. Get started with Ibotta Shop cash back deals wherever you are with the Ibotta app. You'll find offers from your favorite stores on things you buy every day. You have the privilege of using the card anywhere MasterCard Debit cards are accepted. Moreover, you can track your card balance using the StoreCash App. Earn every time you shop gas, grocery, or food with Upside's free top-rated app. Get cash back on everyday necessities, making your purchases more rewarding. Get the highest cash back rewards, up to 15%, at your favorite stores, online or in-store. Money jumps instantly into your account and the cash back offers. Pick up a Centex Cashback Card at participating stores or download the Centex Cashback app and get a virtual card. It may not be redeemed for cash. Download The Coupon app and save up to 60% on the things you need every day. Find great deals, Coupons, Cash Back and Promo code on all near you and around. Unlock Cash Back with the free Upside App! Upside gets you cash back on daily essentials like gas, groceries, and dining. It's designed to reward you for. Get effortless cash back whenever you shop & dine out at stores and restaurants near you. No points, no coupons, no receipts. Just link a card today to.

Refi Rates 20 Year

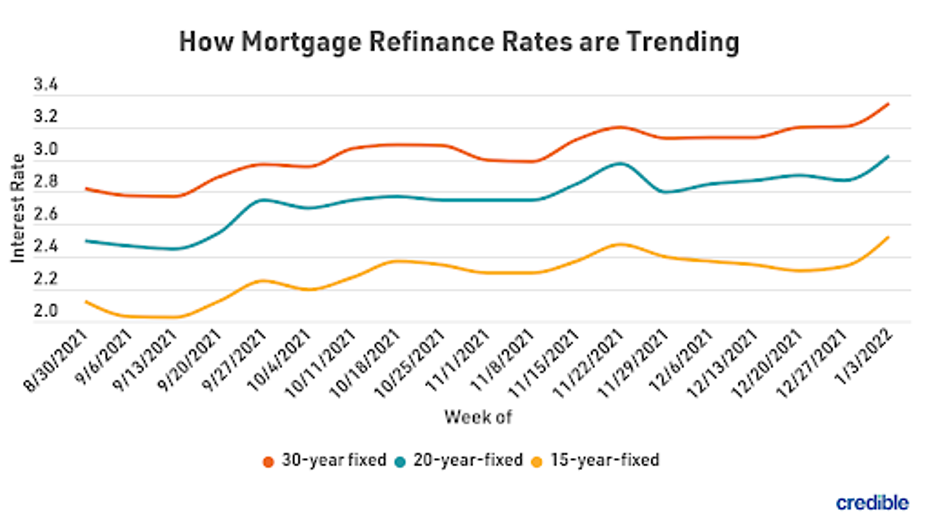

Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. So, if the interest rate on a year fixed rate mortgage is 7%, the interest rate on a year fixed rate mortgage may be %. Second mortgages ; year fixed second mortgage · % · % ; year fixed second mortgage · % · %. Personalize your rate ; 15 Year Fixed. $3, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. See current cash-out refinance mortgage rates using NerdWallet's cash-out refi rate tool The year fixed-rate mortgage is 20 basis points lower than one. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Check year fixed refinance rates. Then personalize them. Your refinance rate depends on your credit score and other details. Options for year fixed refinancing through the credit union start at an APR of %, which is low compared to a lot of the other options. If you live. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. So, if the interest rate on a year fixed rate mortgage is 7%, the interest rate on a year fixed rate mortgage may be %. Second mortgages ; year fixed second mortgage · % · % ; year fixed second mortgage · % · %. Personalize your rate ; 15 Year Fixed. $3, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. See current cash-out refinance mortgage rates using NerdWallet's cash-out refi rate tool The year fixed-rate mortgage is 20 basis points lower than one. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Check year fixed refinance rates. Then personalize them. Your refinance rate depends on your credit score and other details. Options for year fixed refinancing through the credit union start at an APR of %, which is low compared to a lot of the other options. If you live.

Today's competitive rates† for fixed-rate refinance loans ; year · % · % ; year · % · % ; year · % · %. As of Sept. 6, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Rapid Refinance 8 Year Fixed** · $ · % ; Rapid Refinance 12 Year Fixed** · $ · % ; 15 Year Fixed** · $ · % ; 30 Year Fixed** · $ · %. Current refinance rates by loan type ; year fixed rate refinance. %. % ; year fixed rate refinance. %. % ; year fixed rate refinance. On Monday, September 09, , the national average year fixed mortgage APR is %. The average year refinance APR is %, according to Bankrate's. Fixed-Rate Mortgages ; 30 Year - Fixed Rate, %, %, ; 20 Year - Fixed Rate, %, %, ; 15 Year - Fixed Rate, %, %, Mortgage Rates Today ; Product: 20 Year Fixed Rate, Resources: Calculate, Rate: % ; Product: 15 Year Fixed Rate, Resources: Calculate, Rate: % ; Product. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. As an example, with a $, balance at an interest rate of 5 percent, a 30 year mortgage payment would be $1, per month, a 20 year mortgage payment would. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Compare year fixed rates from multiple lenders to find the best year mortgage rate. Check out current rates for a year conventional fixed-rate loan. These rates and APRs are current as of 09/04/ and may change at any time. How Do I Qualify For A Year Fixed Mortgage? · General minimum 3% - % down payment · Minimum - FICO® Score depending on loan type · What you need. The following table shows current year mortgage refinancing rates available in Mountain View. You can use the menus to select other loan durations. Buying A Home Refinancing. Year Fixed. Rate%. /. APR%. Points. (). What are APR and points? Apply To Prequalify · Learn About Year Fixed Loans. Year. Refinance rates ; yr fixed · % · % · ($3,) ; yr fixed FHA · % · % · ($3,) ; yr fixed · % · % · ($3,). Today's mortgage rate for a year fixed-rate mortgage for purchase or refinance, conforming to $1,,**, is % (% APR). In comparison, our 5-year ARM 90 days of purchase rates for someone with a or higher credit score and a 20% or higher loan to value planning to borrow a Conforming amount in. A year mortgage is even better than a regular year loan. Since it has a shorter term, it's considered less risky for most lenders. Compare year fixed mortgage rates from top mortgage lenders, tailored to you. Get actual prequalified rates in minutes.

Nsf Banking

Banks typically charge a NSF fee for each transaction, and these fees too Make sure to look at your bank statements and try to use online banking and alerts. When a check is returned due to NSF, it's returned to the payee that deposited the check, at their bank. This allows them to redeposit the check at a later. NSF means insufficient funds fee. It's a fee charged when a payment is attempted, you don't have enough money, and the bank rejects the payment. Bank Directive on NSF Trust Checks______. Rule (f) of the Rules of Professional Conduct requires a lawyer to direct each bank where he or she maintains. An overdraft fee is a common banking fee charged when you spend more than the amount available in your account. This results in a negative balance, and you may. The NSF proposal would apply to all banks, savings associations, credit unions or other entities that hold an account belonging to a consumer (covered financial. Digital Banking Safety Center Understanding the concepts of overdrafts and nonsufficient funds (NSF) is important and can help you avoid being assessed fees. Overdraft fees are charged when you have a negative bank balance but the transaction goes through; NSF when it's canceled. Learn more. NSF will generate an NSF ID for the new user. The following fields NSF disburses funds to your organization's bank account on the basis of the banking. Banks typically charge a NSF fee for each transaction, and these fees too Make sure to look at your bank statements and try to use online banking and alerts. When a check is returned due to NSF, it's returned to the payee that deposited the check, at their bank. This allows them to redeposit the check at a later. NSF means insufficient funds fee. It's a fee charged when a payment is attempted, you don't have enough money, and the bank rejects the payment. Bank Directive on NSF Trust Checks______. Rule (f) of the Rules of Professional Conduct requires a lawyer to direct each bank where he or she maintains. An overdraft fee is a common banking fee charged when you spend more than the amount available in your account. This results in a negative balance, and you may. The NSF proposal would apply to all banks, savings associations, credit unions or other entities that hold an account belonging to a consumer (covered financial. Digital Banking Safety Center Understanding the concepts of overdrafts and nonsufficient funds (NSF) is important and can help you avoid being assessed fees. Overdraft fees are charged when you have a negative bank balance but the transaction goes through; NSF when it's canceled. Learn more. NSF will generate an NSF ID for the new user. The following fields NSF disburses funds to your organization's bank account on the basis of the banking.

What is an NSF fee? A non-sufficient funds fee occurs when a transaction is declined or returned because there isn't an adequate balance to pay a. Generally, yes. The bank may charge these fees if permitted by the terms of your account agreement. Review your account agreement for policies specific to. NSF fees are typically between $27 and $35, and are limited by a cap instituted by state law. Most states cap these fees at $20, $25, or $35, but some cap at $. An NSF fee is what a bank charges you when there's not enough money in your account to cover a transaction. Think: bounced checks or overdrawing. For specific details regarding an overdraft, or to sign up for overdraft coverage, please visit any Old National banking center or call Client Care at We do not charge transfer fees or advance fees for Overdraft Protection. · Sign onto Online Banking · Unenrolled — if you make a debit card purchase and do not. What is the NSF fee if a customer's Bank payment is returned?If a customer's bank payment is returned, you will be charged an NSF fee of $ Many financial institutions charge NSF fees when checks or Automated Clearinghouse (ACH) transactions are presented for payment, but cannot be covered by the. If payment on a water account is made with an insufficient check or bank draft (NSF), said check/bank draft will be run through twice by the City's clearing. Financial Code § FAQs for State-Chartered Banks and Credit Unions. “Nonsufficient funds (NSF) fees” means fees resulting from the initiation of a. NSF fee on the represented transaction. NSF fees on represented transactions were retained by the bank and did not provide benefits to consumers or. Generally, a bank may attempt to deposit the check two or three times when there are insufficient funds in your account. An insufficient funds fee (sometimes referred to as a non-sufficient funds fee or NSF Handle all your personal banking in one convenient and secure. NSF fees, regardless of whether you have opted in for its overdraft plan. Summary. Non-sufficient funds, or insufficient funds, is a banking term used to. To avoid NSF Fees, contact us about setting up Overdraft Protection on your account. You should also monitor your account balances in Cambrian Online Banking or. Returned Check Fees: Banks or financial institutions typically charge a fee when an NSF check is returned. The fee can vary depending on the bank and the. Innovative FInTech solution for banks and credit unions to help account holders manage NSF and Overdraft situations. Regulatory friendly! VCI (vericheck) is a commercial bank of california company · ACH Payments State Allowed NSF Fees. For check payments that are returned for lack of. NSF fees, regardless of whether you have opted in for its overdraft plan. Summary. Non-sufficient funds, or insufficient funds, is a banking term used to. What is it? An acronym used in the banking industry to signify that there are not enough funds in an account in order to honor a cheque drawn on that.